Disclaimer: Nothing that follows is investment advice. Please see our “Terms” page link below for more information regarding this website.

Segra Capital launched Segra Resource Partners in 2018 to take advantage of what we believed was an underfollowed and mispriced opportunity in the uranium and nuclear power markets. Since that time, investor interest in the space has increased and the price of the commodity and related equities have risen. However, as many of our readers likely know, we have long bemoaned the inefficient deployment of capital in the trade. While not unbelievably surprising (rallies after long bear markets often begin with a flows > fundamentals narrative), we believe relative value opportunities in today’s market stand out more than usual and should be thought about more critically as the cycle progresses.

The Metals and Mining sector is chock full of quotable anecdotes, truisms and sage advice from the industry’s veterans (this advice is freely available on many formats…podcasts, youtube, patreon! All for the low-low price of buying after the speaker is long and likely selling after they do as well!) Among the comments we often hear from anonymous avatar experts:

- “A large market cap is actually a negative for a stock as it limits your upside!”

- “The assets don’t actually matter – it’s about whether the CEO can tell a story!”

- “As a commodity price turns, you actually want to buy the worst companies because they rally hardest!”

While these comments may sound absurd to an investor who has never looked at commodity-related markets, they are repeated because at some point in the cycle they inevitably turn out to be true (and from cycle lows to today, you could argue they would be true for Uranium). However, the same reason advice like this works in the early innings is why most investors live by another saying: “Mining is a bad business – there are easier ways to make money”. At some point, the cycle shifts or market players react, the fundamentals begin to matter and the tourists and novices are led to slaughter. At Segra Capital, we believe that risk and reward are two sides of the same coin and an institutional approach to mining investments (very different from the pure speculation often espoused by day traders) can allow market participants to separate the wheat from the chaff on a through-cycle basis.

With that said, we have always found the market’s treatment of Kazatomprom (Bloomberg ticker: KAP LI, “KAP”) to be a bit of a head scratcher. There are relatively few public uranium companies, and even on a very superficial basis the KAP stats look pretty impressive: 40% market share, lowest cost producer globally, low capex to ramp future assets, fully licensed, recently IPO’d with several years of value over volume strategy behind them. Dig a little bit deeper, and the prospects are a standout in the broader opportunity set.

The company hasn’t had nearly the stock price momentum or valuation re-rate of its peers despite being the most fundamentally leveraged to rising uranium prices. In most conversations, we find that market participants reflexively talk about Kazakhstan/KAP’s potential for ruining the market cycle before any of the aforementioned positives ever enter the discussion. The negative bias is the result of the company’s listing jurisdiction, analyst coverage (more on that later), former status as a state-owned company and generally poor macro work in the uranium sector that lets many half-truths (or outright misstatements) about the company’s role in the coming cycle linger in the pretext of any discussion.

To start, we disagree that the company will, or even CAN, disrupt a higher price trajectory. As we have argued for many years now, the market is structurally undersupplied, and over the next several years fuel buyers will need not only the Kazakh ramp and Cameco’s McArthur River, but significant new mine development as well. The knocks on the story are well known: Kazatomprom IS a former state-owned enterprise which still carries a relatively low public float; Kazakhstan IS a former Soviet satellite state and the market has historically discounted businesses with this jurisdictional profile versus Western peers; and the lack of U.S./Canadian/Australian listing has prevented easy trading access for a key cohort of retail investors.

KAP today is trading sub 10x earnings at market spot prices (KAP LI ~ $36, Spot U ~ $42)… on their curtailed production base. As a reminder, in 2018 the Kazakhs cut production to 20% below their Subsoil Use Agreement targets in an effort to balance supply and demand. This was part of a well-articulated (and today, well executed) strategy of prioritizing “value over volume” thereby creating significant shareholder value. At the time, sell-side consensus was that while a Kazakh cut made sense in the low $20 range, any significant move higher in price would result in a resumption of target production. Fast forward three years and you have actually witnessed the Kazakhs extend production cuts, as recently as this past August, despite prices well into the $30s. While a Kazakh ramp remains a boogeyman for this market, we would argue that actions to date – as well as messaging – indicate that any ramp will be dependent not only on prices meeting the company’s view of value, but also a solid forward contract book (meaning they’ve learned that ramping to sell into the spot market is a self-defeating exercise). Valuing Kazatomprom on fully ramped production (which should be expected in a strong market with the right contract book) the company trades at just 6-7x earnings. For a duopolistic, lowest cost producer (they make up just about the entire lowest quartile of the cost curve) in a structurally undersupplied commodity market – that’s a juicy discount, even when adjusting for any jurisdictional discount.

Cheap is not always good enough, so we’ll shine a spotlight on a few points we think are outside of the purview of the average investor. Maybe they help contextualize the opportunity today.

Regional Stock Coverage and the Great Valuation Arbitrage

KAP is covered mostly by CEEMEA (Central & Eastern Europe, Middle East and Africa) Metals & Mining analysts at bulge bracket banks. The majority of their coverage universe is base metals related, and most would openly admit that (1) KAP is a unique coverage stock for them; and (2) Uranium and nuclear fuel cycle macro analysis is… well, let’s just say it isn’t high on the list of things global banks have dedicated time or big research dollars to get right. Many times these analysts compare Kazatomprom not with western peers like Cameco or other specialty commodity powerhouses like SQM (in Lithium), but with Russian Mining and Oil and Gas stocks. This is not because the comp set is right, but because they are limited to the other stocks in their coverage universe.

The result of this analyst arbitrage is that forecasts and valuations for KAP have historically been based off some rather stale and conservative commodity price decks when compared to other uranium companies. Because only a few of the analysts spend much time on the uranium market more broadly, they rarely release research reports when major macro catalysts occur. We counted four total reports released between Mid-August and November (10 banks we follow cover the stock)[1] – a time during which Sprott took over UPC and the uranium price ran from $30 to over $50. Can you think of another commodity sector where the underlying price could rise 65% without the covering analyst releasing a note? Unfortunately for Kazatomprom, the vast majority of analyst work can be summarized as a quarterly “mark-to-model” (more on that later).

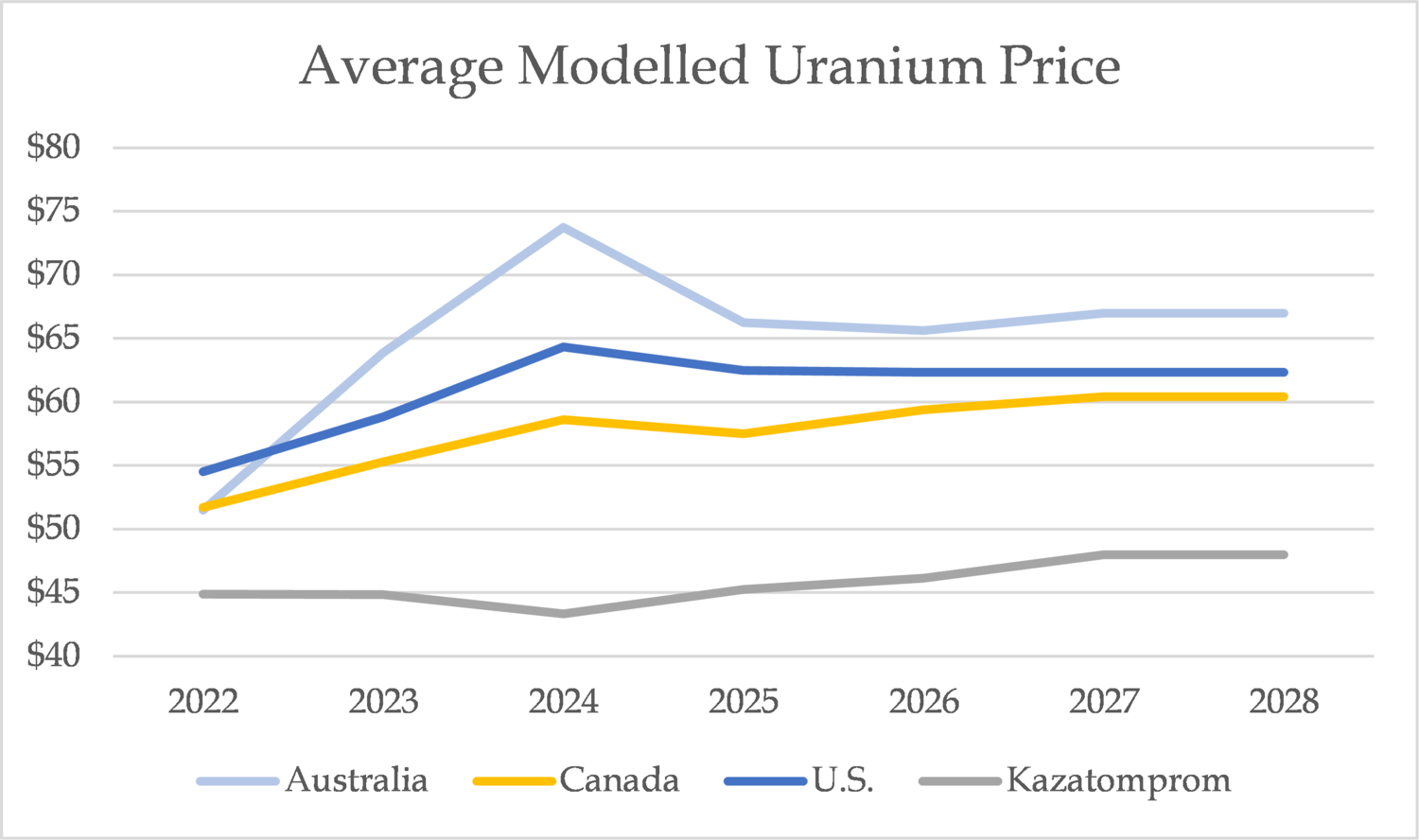

In the few updated forecasts that exist, $35-$50 pricing in perpetuity is the best KAP receives from the sell-side community.Below you can find the average uranium price that backs the sell side’s valuation and price targets on uranium stocks in various regions:

Non-CEEMEA analysts are more constructive (and realistic) on uranium prices and that feeds into implied stock valuations. Today, ASX listed names on average are pricing approximately $75 per pound at 1x NAV. It is no surprise that the Australian sell-side has by far the highest price deck of global peers! U.S. listed uranium names are in the same valuation ballpark. Even in the relatively unloved Canadian sphere, analysts are assuming Uranium prices in the ~$60 range long term. To hammer the point, the spread between uranium price forecasts for the average KAP analyst and Aussie listed stocks is close to $20 – in what market do bellwether producers get a 30% discounted price assumption to non-producing exploration companies?

Today you buy KAP at a single digit earnings multiple and a discount to NAV on a market price deck. If you run more appropriate cycle prices, the numbers start looking relatively silly. The company also has negative net-debt, a healthy and growing dividend with a clear distribution framework, and a large exploration portfolio capable of replenishing their current asset base over time. We aren’t going to walk you through our model, but there should be more than enough valuation arbitrage to get investors over the rather shallow hurdles to ownership.

Outside of Price Forecasts, What Does the Average Analyst Do Wrong?

KAP is the unfortunate victim of a “damned if you do, damned if you don’t” approach to equities analysis. Putting aside for a moment that several analysts have yet to update their forecasts for the ~50% rise in uranium prices since the late summer, the coverage that is up to date on the company (including an unnamed analyst who started the recent selloff in the stock with their latest downgrade) generally do the following: in their macro price forecasting it is assumed that KAP puts a ceiling on uranium prices into the future (around current levels), thereby handicapping the realized prices the company achieves out over the next decade. At the same time, the company does not get full earnings credit for the theoretical pounds they are ramping to keep prices capped! Said differently, the company’s NAV calculation is hit by the lower prices resulting from a production ramp, while their earnings analysis gives them no credit for the increased production.

Equally damaging is that KAP’s cost structure is generally escalated on a compounding basis at local CPI, while the realized uranium price forecast stays relatively constant. As a result, operating margins get nailed. Why is the lowest cost producer going to kill their own margins in an undersupplied market with rising mining cost inflation? We believe management knows the strength of their current position, further supported by how the company’s marketing team (responsible for contracting) has handled the rising price environment over the last several years. Let’s not forget that even the lowest cost producer has been waiting years for the cycle to turn, and they aren’t giving anything away for a song “just because”.

A last nail in the modeling coffin is that over the long-term (out past the next five years) most models have KAP’s asset base going into decline, which fully ignores the high quality portfolio of exploration assets held by the company. If the Kazakhs get to the point of natural production runoff, are prices flat at $45-50 long into the future… in a market that is in persistent deficit?! And the next natural question is, if there is no incentive for low-cost Kazakh assets, why are high cost and high CAPEX development projects getting premium credit in today’s equity markets?

Again, our argument is not that KAP will be the only producer in town. Instead, we don’t believe the company should be modeled as a price taker (vs price maker), with declining operating leverage and production at the start of a contracting cycle they are in pole position to exploit.

Sales and Deliveries

We would be remiss not to point out that year after year the market seems to misunderstand how KAP books business, and often punishes the stock when reporting their interim operating results for Q1-Q3. To set the record straight: the company gives sales guidance for the year and recognizes those sales on the date that material is delivered. At this point in time, KAP’s contracts are mostly based on market-related pricing. This means that their customer is going to pay a price for uranium that is related to the market price when the material is delivered.

Historically, Q4 has been the busiest delivery period for the company. Do not be surprised if the company has not sold 3/4th’s of their sales guidance, 3/4th’s of the way through the year! The key is to focus on management guidance at the end of the third quarter to gauge confidence in fourth quarter delivery volumes. In fact, in years where the uranium price has risen dramatically between the third and fourth quarter (like 2021), it is actually a MAJOR positive to have the bulk of deliveries occur into year end (we did not see a single analyst point this out after a Q3 headline sales “miss”).

Despite this basic dynamic, headlines around the interim update always present KAP as being at risk of missing their year’s financials. The stock usually sells off. Hopefully the above clarifies why a light Q1-Q3 should not be a legitimate risk factor to full year earnings, barring a change in company sales guidance. If sales guidance is maintained, and deliveries are light in Q1-Q3, all it means is that Q4 is going to be gangbusters. Frankly, we find it surprising that analysts are not celebrating the good fortune of having a majority of deliveries occur in the fourth quarter where prices are generally $10-$15/pound higher than Q1-Q3.

Market Comps

At this point your general interest may be piqued, but your instinct is to say, “so what… markets are efficient and perhaps Mr. Market has spoken when it comes to KAP. Maybe the company’s jurisdiction, government ownership and pre-IPO practice of volume over value justify the current multiple discount?” This question is, in our opinion, where the rubber meets the road on KAP. We are confident that underlying earnings/cash flow/dividends will continue to surprise versus consensus, but when will market multiples better reflect KAP’s unique position in the uranium market?

What seems to be overlooked today is that in themes where the investable universe is limited, swing producers can and should trade at healthy premiums regardless of the “issues” previously presented. Look no further than the Lithium sector, which we think serves as a strong comp: it is a niche commodity market levered to the energy transition, with a small handful of global producing majors, many of which have state ownership and operate in non-Western jurisdictions.

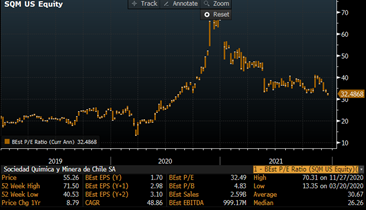

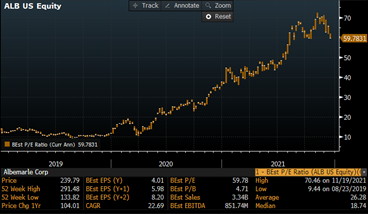

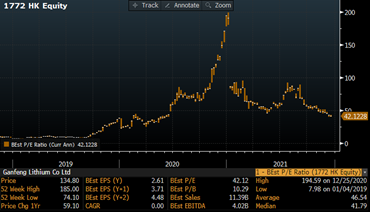

Lithium majors’ P/E below:

While the above is only being used for illustrative purposes, what you see is an enormous re-rating in market multiples for the leading Lithium producers in an environment where two things are accepted as true: (1) Lithium is critical to the energy transition; and (2) The market is structurally undersupplied.

Sound familiar?

In the 2015-2018 period earnings multiples were not dissimilar from KAP’s today. Many of the concerns about KAP’s role in the uranium market echoed for Lithium as competing greenfield development projects put future supply/demand in doubt. Then it all changed in a flash. Putting aside the big spike in the graphs mid-2020 (which is a little misleading, and an explanation for which is beyond the scope of this writeup), earnings multiples have moved from 10 -15x to settle closer to the 30-40x range.

We are not clairvoyant and make no projections about when the market will embrace KAP in the same way as it did the Lithium majors (SQM being the best comp, given jurisdiction, government involvement, etc.). But the precedent is there. A U.S. listing is clearly a key factor in helping to re-rate the stock and we do not see this as an insurmountable hurdle for the company, even if it may take some time (mostly because the company would be subject to more frequent filings… no easy feat given their complex JV structures).

Investors get to front-run that possible event with a very large margin of safety given where we are today. As a result of the post interim update selloff, there are more than a few institutions that have taken a negative view on the full year financials – we think that is a mistake which will be corrected in the market’s eyes when the full year is reported. Finally, if the bull market is to persist, regional analyst overlap will pick up and wildly diverse macro assumptions will converge. Whereas you are rewarded for owning many exploration companies with frequent dilutive financings, you could own KAP and get paid a healthy and growing dividend with more cyclical leverage than the rest of the industry combined. For those reasons, we believe KAP is the most asymmetric opportunity in today’s market though it is rarely mentioned as such.

Thanks for reading,

Segra Capital Management

[1] In our view BMO’s Alexander Pearce does by far the most industry and company specific work. We would also separate BAML’s coverage, led by Anton Fedotov and the differentiated macro work of Lawson Winder from this generally critical sell-side review.